Two people played a crucial role in my professional life—Dr APJ Abdul Kalam, under whom I worked first from 1982 at the Defence Research and Development Organization (DRDO) and later as his pupil till he departed in 2015, and Dr B Soma Raju, Cardiologist…

Children of the Earth and the Sky

Children of the Earth and the Sky

The Indian diaspora has excelled in the modern world. Indian-origin engineers are heading three top technology companies of the world – Microsoft, Google, and IBM – and many more. There is hardly any company or university where Indians are not present, holding responsible positions and carrying out work of consequence. The Science Advisor to the President of the United States, the President-designate of the World Bank, and so on. Ancient Indians called themselves the children of the earth and the sky – तन्माता पृथिवी तत् पिता द्यौः। (Rig Veda 1.89). As local people pride themselves as sons of the soil, I celebrate overseas Indians as children of the Sky.

Abhijit and his wife Juri work for Honeywell, a multinational conglomerate corporation headquartered in Charlotte, North Carolina. With their 11-year-old son Abhiroop, they live in Bracknell, 40 miles west of London. Bracknell is a post-World War II, newly-built town, like Chandigarh in India. They do not own a car because their office is within walkable distance, and for every other commute, there is public transport.

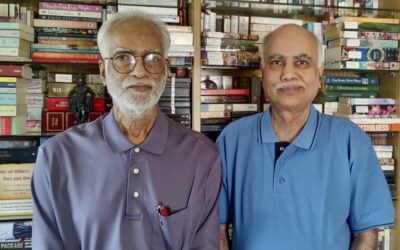

Abhijit was born in Sivasagar, some 300 kilometers northeast of Guwahati, south of the Brahmaputra River. He did his Master’s in Polymer Chemistry from Tezpur Central University. He has fond memories of receiving the degree from President APJ Abdul Kalam who came to the convocation in October 2002. I, too, was there as part of the entourage.

Not knowing what next, Abhijit came to Mumbai with three other graduate friends to find a job. They end up working as shop floor technicians in small-scale companies (as good as laborers) and a chemical factory and struggled for about a year, surviving somehow in the Maximum City before getting a proper job with Asian Paints.

Abhijit was sent to China by the company in 2006, and he worked in Shanghai for 3 years. After returning to India, he married Juri who was working for a US MNC in Gurgaon. She resigned from her job and moved to Mumbai after marriage. But when Abhijit got a job with Honeywell as a Product Application Specialist in their newly set-up facility in Gurgaon, the newlyweds were perplexed. Addressing their plea positively, Honeywell recruited her as well, and the couple moved to Gurgaon. They were blessed with a son in 2011 and named him Abhiroop.

In 2015, Juri got a promotion and was posted in Bucharest, Romania. Abhijit also got a breakthrough to make a lateral change in his career and started as Sr Strategic Buyer in Bucharest, overseeing 100 million dollars spent. Time moved on, and eventually, they came to the UK in 2022. Though they literally are living as children of the sky in their careers, they remain rooted in their culture. Abhiroop speaks to his grandparents almost every day on video calls in Assamese.

Geography used to define destiny. Earlier, people born in the hinterlands remained trapped in isolation. No proper education, no good employment opportunities, and the mindset of a sectarian living spoiled countless lives akin to buds never blossomed. The struggle of Abhijit and Juri in their early life is an example of the end of that era. The world has opened now, and talented and hardworking people are welcomed with open arms. But it took almost 100 years!

Rabindranath Tagore (1861-1941) was an emblem of the universal spirit. In the early twentieth century, when the idea of independence was fermenting in India, Tagore asked the fundamental questions: Independence for what? Freedom from whom? Liberty for whom? He penned the iconic poem – Chitto Jetha Bhaiyashunyo (Where the mind is without fear). This one poem, written as one long sentence without rhyme, stands testified by Abhijit today.

Where tireless striving stretches its arms towards perfection

Where the clear stream of reason has not lost its way

Into the dreary desert sand of dead habit

Where the mind is led forward by thee

Into ever-widening thought and action

Into that heaven of freedom, my Father, let my country awake.

India is celebrating 75 years of independence, and from now to 2047 has been declared as the Amrut Kaal, a quarter of a century when India must find its rightful place in the global community. For the first time, India is asserting itself as a civilization.

Besides children of the earth and the sky, वसुधैव कुटुम्बकम् (Maha Upanishad VI. 71) is another central idea of the ancient Indians – this entire world is one great family. How different it is from the violent creeds of denominational supremacy in Europe, which created havoc on the planet in the form of the brutal colonization of Asia, Africa, Australia, and America? What a great contrast it makes with Nazism, Fascism, and the Crusades!

The hallmark of modern times is connectivity. Five hundred million Indians are now continuously connected to the Internet through their mobile phones. This connectivity is almost free, and though many may not cherish the blessing, it is not available yet for billions of people elsewhere in the world. It has become so easy to seek knowledge, know the answers to our questions, and be in the mainstream, wherever one may live in geographical terms.

It can’t be a coincidence, a favor, or a preference but a tell-tale sign of the purity of the soul and clarity of the mind that Indian civilization has bestowed upon its people that is shing through Satya Nadella, Sundar Pichai, Arvind Krishna, Arti Prabhakar, and thousands of other achievers like them. That Ajay Banga, who studied in Hyderabad Public School, where my grandson is now studying, will be President of the World Bank for a five-year term beginning June 2, 2023, is both inspiring and joyous for the Indian children growing up today.

But what pleased me the most about Abhijit, Juri, and Abhiroop is that they remain connected to their roots while living abroad. A tree is called a giant only when it is alive and draws nutrition from its roots. Once its roots are severed, a tree becomes material – bagasse and timber – to be used and consumed. This truth must be internalized by millions of those who, though physically remaining in their hometowns and even joint families, are overwhelmed by the nuclear lifestyle and do not care for their aged parents and support their siblings.

Rabindranath Tagore, while celebrating the mind without fear and the head held high, also cautioned against this narrowmindedness and selfish attitude.

Where the world has not been broken up into fragments

By narrow domestic walls . . .

Wars will be redundant soon. I have no doubt, whatsoever, that India would lead the world, not in the military or political sense, but in the Buddha way, living peacefully, doing virtuous and wholesome deeds, and treating other sentinel beings, including animals and plants, with compassion. The Indian ethos of loving-kindness would prevail over the greed of commerce and ideological violence. Those who take care of the earth are looked after well by the sky too!

MORE FROM THE BLOG

Is Life a Game?

Will 2025 be ‘Year One’ of the New World?

Certain words and phrases gain prominence at different times, and this is becoming a fashion in the Internet media world. “Deep State is currently circulating about the mysterious powers that run the world…

Knowledge comes from Within

David Deutsch (b. 1953), a British physicist at the University of Oxford, is among the world’s foremost philosopher-scientists alive. He has worked on fundamental issues in physics, particularly quantum computing, quantum information and constructor theory. I learned about him through his books…